4 May chart overview for EURUSD and GBPUSD

- During the Asian session, the euro tried unsuccessfully to consolidate against the dollar.

- During the Asian session, the British pound continues to consolidate against the dollar before tonight’s announcement of the Fed’s interest rate.

- German exports fell more than expected in March, while import growth exceeded expectations, according to data released by Destatis on Wednesday.

- The growth of UK manufacturing increased in April compared to the March level.

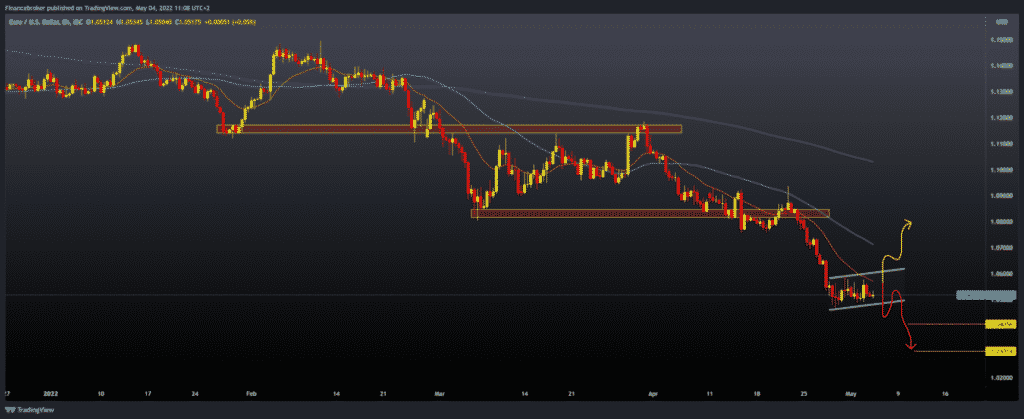

EURUSD chart analysis

During the Asian session, the euro tried unsuccessfully to consolidate against the dollar. A new set of sanctions against Russia is expected today, and an embargo on oil imports is being prepared. The long-term deterioration of the EU’s relations with Russia – economically, politically and diplomatically, along with the war in the neighbourhood – is putting pressure on the euro. On the other hand, the “hawkish” positions of the creators of monetary policy in the United States on the need for a rapid and decisive increase in interest rates give strength to the US dollar. The euro is exchanged for 1.05280 dollars, which represents the strengthening of the common European currency by 0.07% since the beginning of trading tonight. Today, we are expecting a meeting of the US Federal Reserve, and at 20:00, an official announcement will be made after the meeting the US Federal Reserve on the change in the interest rate. As of April 28, the EURUSD pair is moving in lateral consolidation, forming a parallel channel. The market has been stable for the last few days, and all eyes are on tonight’s Fed decision. An increase in the interest rate should strengthen the US currency, which would negatively affect the EURUSD pair. We can look for potential support in the zone around 1.04000; then, if the bearish trend continues in the following period, the next support is at the 1.03000 level.

Chart:

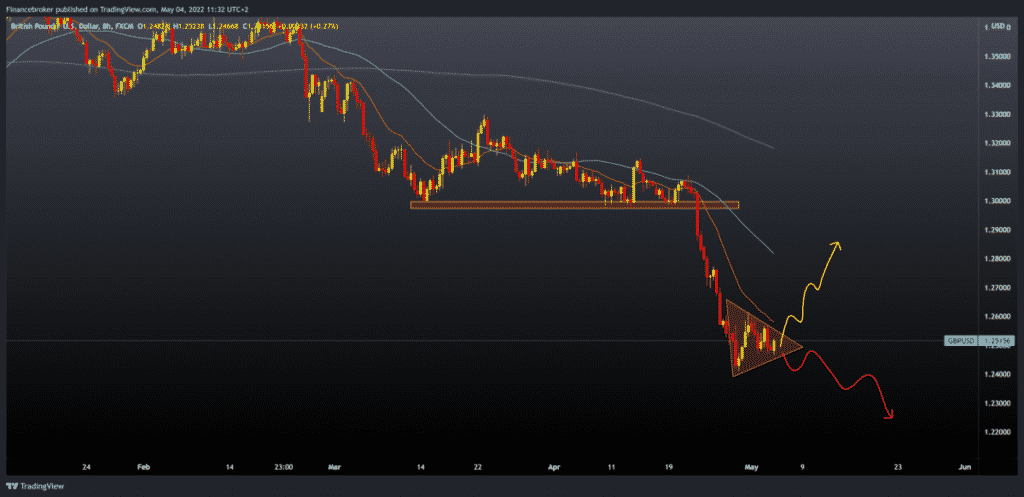

GBPUSD chart analysis

During the Asian session, the British pound continues to consolidate against the dollar before tonight’s announcement of the Fed’s interest rate. The US currency is much stronger against all major currencies due to speculation that the US Federal Reserve could rapidly and substantially increase the reference interest rate. Also, poor macroeconomic data in the UK is already threatening the prospect of a rapid increase in interest rates on the British Isles. The pound is trading at $ 1.25585, which represents a strengthening of the British currency by 0.11% since the start of trading tonight. A regular meeting of the Bank of England awaits us tomorrow. The pound has been moving in one triangle for the last few days, and it is evident that we will soon see an impulse that will throw us out of this triangle. Bearish pressure is more dominant, and tonight’s decision of the Fed could increase the pressure on the pound and send it to a new minimum this year. Our potential support is at 1.24000, and if we see a break below the next zone, our support is 1.23000, then 1.22000 level.

Chart:

Market overview

Fall in German exports

German exports fell more than expected in March, while import growth exceeded expectations, according to data released by Destatis on Wednesday.

Exports fell 3.3 % on a monthly basis in March, up from a 6.2 % increase in February, and total imports rose 3.4 % after rising 4.7 % in February. Exports to Russia fell by 62.3 % due to sanctions imposed as a result of Ukraine’s fight against Russia. Year-on-year export growth fell to 8.1 % from 14.5 % in February. Also, imports increased by 20.1 %, after the February increase of 25.0 %.

Growth UK manufacturing

The growth of UK manufacturing increased in April compared to the March level, which was the lowest in the previous five months. This was shown by the final results of the S&P Global survey on Tuesday. The Chartered Institute of Procurement & Supply Production Manager Index rose to 55.8 in April from 55.2 in March.

Companies have linked higher production to increased new job inputs, reduced delivery delays and efforts to eliminate backlogs. Employment rose for the sixteenth month in a row in April as companies reacted to increased production and an increasing number of backlog orders.