March 31 chart overview for Bitcoin and Ethereum

- The price of bitcoin is calm at the moment and is consolidating above $ 47,000.

- he price of ethereum is slowly coming out of this consolidation and turning to the bullish side.

- MEPs today debated that they support stricter protection measures for transfers of bitcoin and other cryptocurrencies, which is the latest sign that regulators are tightening the free movement sector.

- Crypto stocks continue to work in line with technology stocks despite the recent rise in the price of Bitcoin.

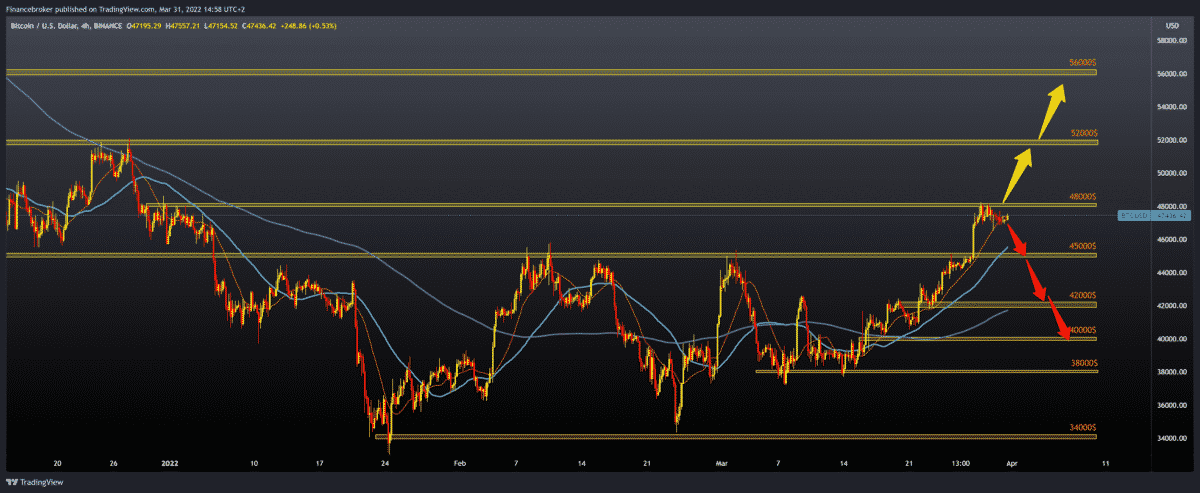

Bitcoin chart analysis

The price of bitcoin is calm at the moment and is consolidating above $ 47,000. It is currently impossible to estimate a further trend, and we need a break above $ 48,000 to continue on the bullish side or a pullback below $ 47,000 to continue on a bearish side down to the $ 45,000 support zone.

The dollar index is also calm today, which is a sign for investors to wait for a more concrete shift on the chart. For bulls, it is important that the Bitcoin price finds support and makes a break above $ 48,000. After that, the space opens up to the previous high at $ 52,000. Before that, we come across a $ 50,000 psychological level, and here we can expect some consolidation or resistance. For the bearish option, we need continued negative consolidation and pullback prices down to support at $ 45,000. Additional potential support for us is the MA50 moving average at that level. The MA200 moving average is in the $ 42,000 zone.

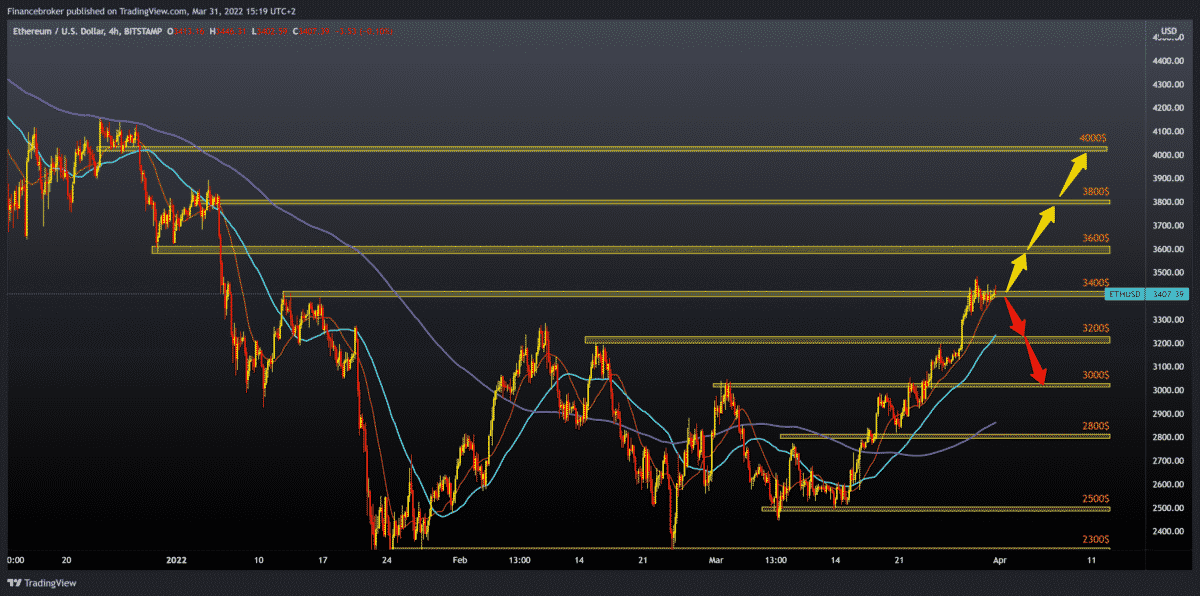

Ethereum chart analysis

The price of ethereum is slowly coming out of this consolidation and turning to the bullish side. The price managed to stay above the support at the $ 3,400 level. Our next bigger target is the resistance zone at $ 3,600, but we have to test the $ 3,500 psychological level before that. If we managed to climb to $ 3,800, we would cancel all the losses that ethereum made during the first three months of this year. We need negative consolidation and a pullback below $ 3,400 to the $ 3,200 support zone for the bearish option. Additional support at that level is in the MA50 moving average. A break below would bring us down to a psychological level of $ 3,000.

Market overview

EU and monitoring crypto transactions

MEPs today debated that they support stricter protection measures for transfers of bitcoin and other cryptocurrencies, which is the latest sign that regulators are tightening the free movement sector. Crypto exchange Coinbase Global Inc said the rules would lead to a surveillance regime that stifles innovation.

Concerns that bitcoin and other cryptocurrencies could disrupt financial stability and be used for crime have accelerated the work of policymakers to bring the sector to an end.

The Commission has proposed applying the rule to transfers of € 1,000 or more, but under the inter-party agreement, this rule has been repealed, which means that all transfers will be covered by this regulation.

The exemption for small value transfers is inappropriate, as cryptocurrency users could evade the rules by creating an almost unlimited number of transfers. Urtasun also cited small amounts involved in crime-related transfers.

EU countries have a common word with the parliament on the law’s final version. The countries have already agreed that there should be no limit for transactions and that they should all be covered by the regulation.

Crypto stocks are not following the rise in Bitcoin price

Crypto stocks continue to work in line with technology stocks despite the recent rise in the price of Bitcoin. Despite rising prices, cryptocurrency stocks are struggling to raise their value. Cryptocurrency companies listed on the public stock exchange are struggling to benefit from the recent price jump. Cryptocurrency mining stocks have suffered the hardest, with their stocks losing more than half their value since November.

Shares of bitcoin mining company Stronghold Digital recently fell more than 30% after a painful loss of revenue that found some shareholders unprepared. The company’s prospects for the rest of 2022 remain bleak now that it has admitted that its ambitious hashtag goal will not be achieved due to operational problems.

Shares of Bit Digital, Hut 8 Mining Corp. and other prominent mining companies have fallen more than 20% since the beginning of the year, although the price of Bitcoin briefly turned green in the same period.

Shares of MicroStrategy, a company focused on business intelligence, also fell more than 10% from a year earlier.

-

Support

-

Platform

-

Spread

-

Trading Instrument