26 May chart overview for Oil and Natural Gas

Oil analysis chart

During the Asian session, the price of crude oil remained in a narrow range of oscillations between $ 110 and $ 111.40. An official government report on the state of stocks showed yesterday afternoon that crude oil stocks in the United States fell by 1.02 million barrels. David Malpass, the head of the World Bank, warned that the war in Ukraine could lead to a global recession, given the rise in the prices of energy, food and artificial fertilizers. The EU is still trying to persuade Hungary to agree to sanctions on oil imports from Russia. A meeting of EU leaders will be held at the end of May. Crude oil is trading at $ 111.38 a barrel, up 1.00% from trading tonight. We need a break above the $ 112.00 level to continue the bullish option. After that, the price would form a new high this week, which would be a sign of potential further growth in oil prices. The following targets above are $ 113.00, $ 114.00 and $ 115.50 level, last week’s high on May 17th. For the bearish option, we need a pullback price below $ 110.00. After that, we could expect a further withdrawal of the price towards the lower support line. Potential bearish targets are $ 109.00, $ 108.00 and $ 107.00 on the bottom line.

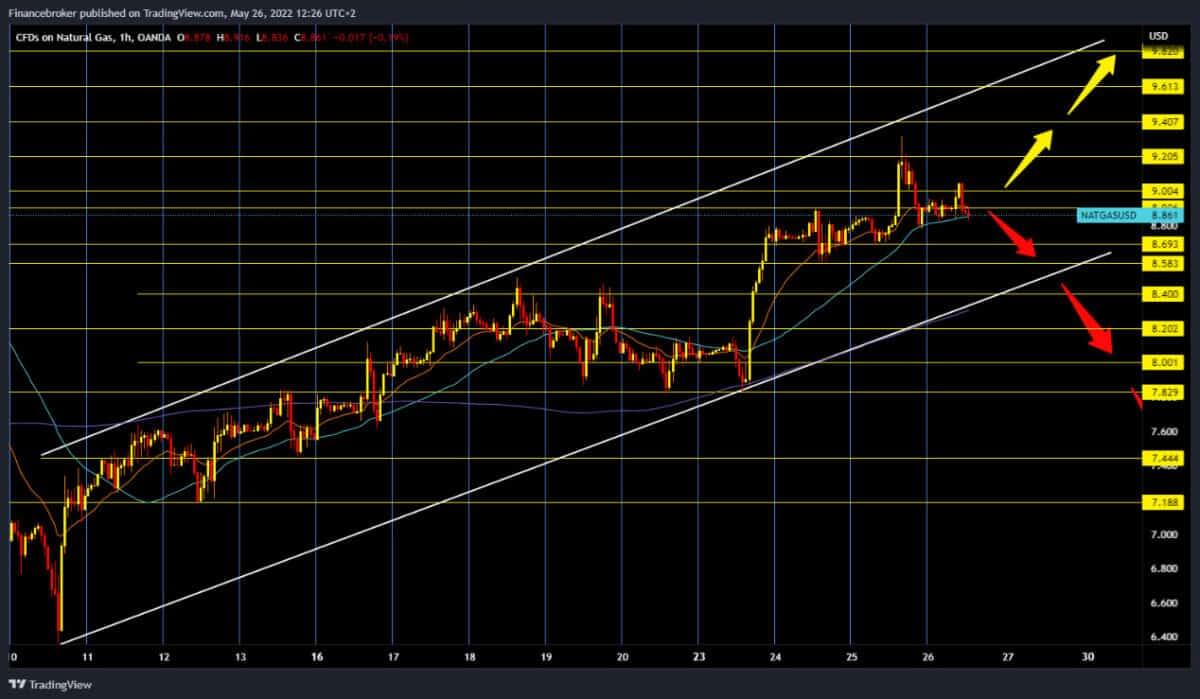

Natural gas chart analysis

The price of natural gas reached a new high of 9.33 dollars this year. After that, we have a pullback to the MA50 moving average at $ 8.80 price. During the European session, the price of natural gas was another $ 9.00, and now we are consolidating at $ 8.90. We have been in the bullish trend since May 10, for the sixteenth day in a row. To continue the bullish option, we need new growth above $ 9.00 and new testing of the previous high at $ 9.33. If the price of natural gas made a break above, it would open up space for us to climb first to $ 9.40, then $ 9.60 and maybe $ 9.80. For the bearish option, we need a negative consolidation and a pullback below MA50 and $ 8.80. After that, we can expect a smaller pullback to the bottom line of support. Our potential bearish targets are $ 8.70, $ 8.60, $ 8.50 and $ 8.40.

Market overview

Considering the preliminary data of the CME group for the crude oil futures markets, the open interest rate increased by about 11.2 thousand contracts on Wednesday, reversing the previous daily decline. On the other hand, the volume reversed two consecutive daily upgrades and decreased by about 80.2 thousand contracts.

Oil prices have calmed after a sharp rise at the start of the war in Ukraine. Commerzbank’s strategists expect Brent oil price to fall to $ 95 per barrel by the end of the year.

“We expect the price of Brent oil to continue to fluctuate between $ 100 and $ 115 a barrel in the current quarter before dropping in the second half of the year.

By the end of the year, expectations are Brent should be trading at $ 95. This is based on the assumption that the EU will impose an oil embargo on Russian oil. This would increase the demand for non-Russian oil, and the effect would have price increases and thus justify a slightly higher level of oil prices in the second half of the year than we have expected so far.