2008 Economic Crisis vs. 2020 – Signs of Recession?

In-light of current events, a lot more issues than what you might expect have been arising. Sure, the borders are beginning to close worldwide, the stock market has drastically dropped, and the governments are looking for solutions left and right. But on top of everything else, there is something that no one is willing to discuss. We seem to be seeing signs of a severe economic recession of this century – yet again.

The first time we faced such an issue was in the last decade – one of the biggest economic impacts due to the crash of the market. What was the primary cause of the crash in 2008, and what kind of relationship does it have to the current situation? To find a quick and easy recap of the 2008 events, please scroll down to the bottom of the article.

The first sign: The Oil Market

After the destabilization of the economy in 2008, the stock market began to crash. The biggest companies on the stock market dropped by billions of dollars, with the oil stocks facing the most severe losses.

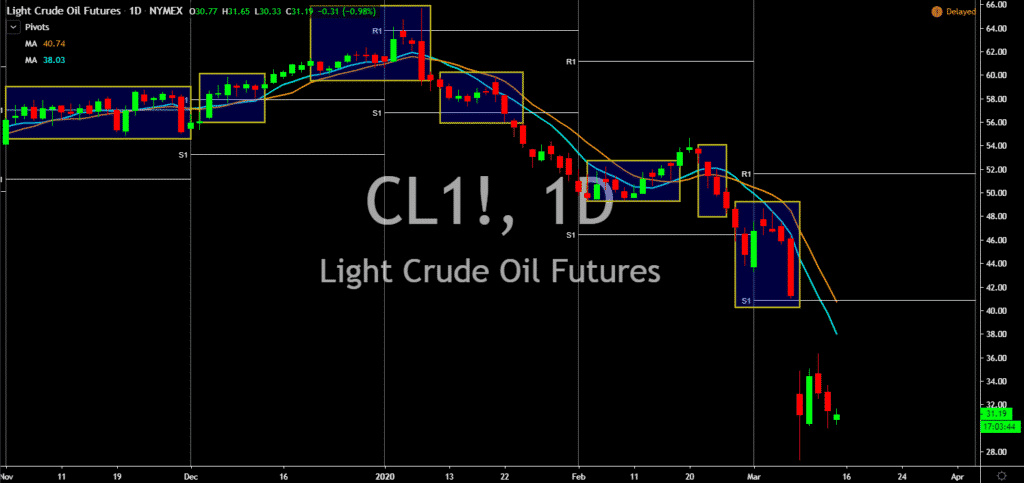

What is happening in 2020 on the market? The first sign for them all is the oil market. The values have been dropping drastically, with BP reaching a close to 20% crash and Shell falling by 18%. These are only two small examples of the big market overall. If you look at the chart below, this may slowly become apparent to you. We have chosen November 2019 to March 2020, a short time-frame, to show the apparent drop. The relatively steady price in the last months of 2019 shows the stability of the asset. Crude oil is always a “beginner’s investment”, as they call it, due to its easy predictability and stability.

At the beginning of 2020, oil prices started to rise – as they usually do. Then as the coronavirus started to become a daily part of our lives, the oil prices began to slowly go downhill. At the beginning of March, it seems like the bulls tried to pull it up by several factors only for it to fall even more. You will notice the pivot points predicting this type of fall starting January 13, 2020, as the open-close ends in a negative. Then slowly, we begin to see inverted red hammers pulling down the moving average quite significantly. Only to see the final big red candle predicting further losses.

How is this similar to 2008 oil behavior?

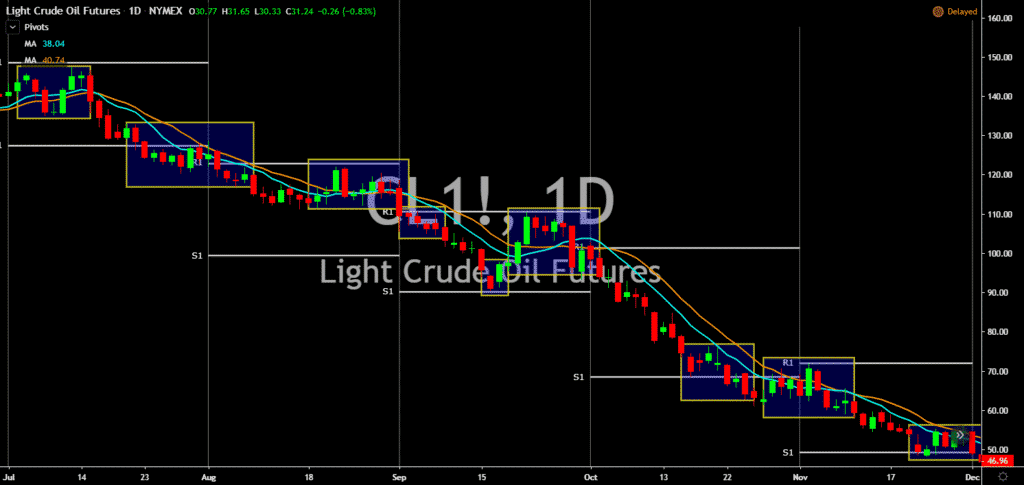

Let’s take a quick look at the 2008 summer chart when it began to drop. Around July, everything seemed fine until we saw the ominous open-close candle, which then allowed for the inverse hammers and shooting stars to begin manipulating the prices. Around October, the prices rose again, which may indicate that the bulls were trying to help the asset from dropping too low.

After that, we saw yet another pivot red candle, which signaled the hugest losses. And then it kept going down until it finally reached its low peak. Do any of these look or sound familiar? Well, that’s all because oil is on the same path as it was in 2008, signaling a much bigger crisis.

Why is this happening?

Coronavirus has been affecting us in more ways than we can see, especially in the stock market. But why is this phenomenon so important? Well, since one of the biggest energy importers is going through an in-house crisis, the stocks for oil have been dropping severely. Factories have been put on hiatus and flights canceled all over the world due to the pandemic.

It is unfortunate to say, but small countries will have a hard time recovering from such a big economic crisis, which is still only just building up. Seeing such drops in the oil market, we can begin to predict what might come next. Once the oil reaches its bottom peak, we will see a huge rise in gold. Gold being the safe haven of the market, it will hold most of its value due to the fallen oil. Once gold reaches its peak, the stock market will crash.

Once the stock market crashes, the global economy will begin a full recession. Or has the stock market already begun to crash without us even noticing it?

The second sign: The stock market

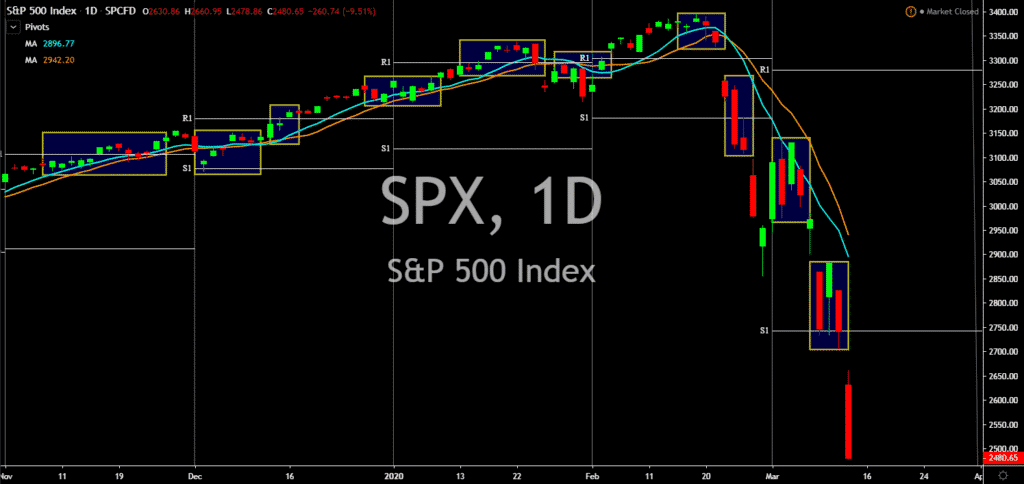

All stocks have been falling and are expected to fall by 20% in the upcoming months. Currently, S&P has fallen by around 10% and has been in decline since the second part of February. If you look at the chart from 2020, you will notice regular high movements from November to the beginning of the year. All markets feed well during the holidays, and S& P was seeing some good signs until the end of February when the pandemic began to spread worldwide. The stocks began to drop drastically, and it seems like there’s no end to it so far. They keep dropping and dropping, and will keep going until they reach their cap.

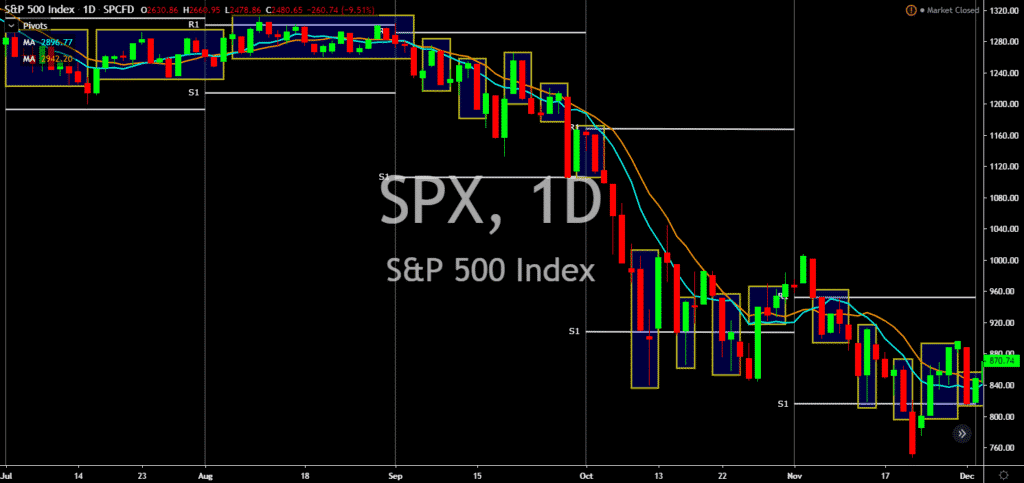

How is this similar to the 2008 crisis? Well, at this same time period for oil, S&P was doing well in the summertime. But then around the beginning of September, the stocks began to drop drastically with the very same candles predicting this behavior. Around November, the stocks were boosted up by the bulls, after which they continued to collapse. We are expecting the same type of behavior in this decade as well.

Quick and Easy Recap of The 2008 Events

The main issue in 2008 arose due to the deregulation of the financial industry. Once the government eliminated its power, more competition arose. Banks began to make money through unfit means, and they realized that derivatives gave them much more money than loans. Thus, they gave out a lot of loans to people who could not afford them in order to gain more through the derivatives.

Soon enough, the real estate market lost 30% of its value and began to sell extremely cheap. Once the real estate market fell, the oil began to fall as well. In our current case, oil is falling as countries do not have the demand for it. In 2008, it fell because the demand was too high, but no one could afford the product. Thus, oil went down, gold went up, and stock markets began to go down as well.

The 2008 economic recession taught us several things that we need to consider in this current stock market. First of all, this is the best time to buy land. Not real estate! Land. The difference is important as once the stocks begin to fall, the supplies and manual work will become much cheaper. Soon, you can build the home and sell it for a much higher price once the market is restored.

Use the same tactic in your trading. Whatever is cheap now, buy it only to sell it once the sheep come rushing back to the instruments. It is a guarantee that the stocks will get back in shape once the panic and pandemic is over. Where else can they go if not higher?

The third sign: The Little Things

To top it all off, we want to mention that CEOs of very large corporations have been retiring. We need to consider this as a sign that another recession is very close to us. Why did Bob Iger leave Disney? Maybe because he knows what is about to come, and he wants to take all the money and bolt to avoid any severe losses in the next couple of years. We should take this into consideration since no one knows what will happen better than someone who is already handling a lot of money. If they run, maybe it’s time for you to run too. Or maybe it’s time to take advantage of the most volatile market of the decade and turn losses into profits through smart trading.

If we combine MTFA with technical analysis, you will be able to predict specific stock behaviors. Just remember one thing, if it’s dropping now, it will rise even higher once the crisis is over. And since this is a circumstantial crisis, it can be handled within a few months. Do not run away from the panic, take advantage of it, and trade smart.

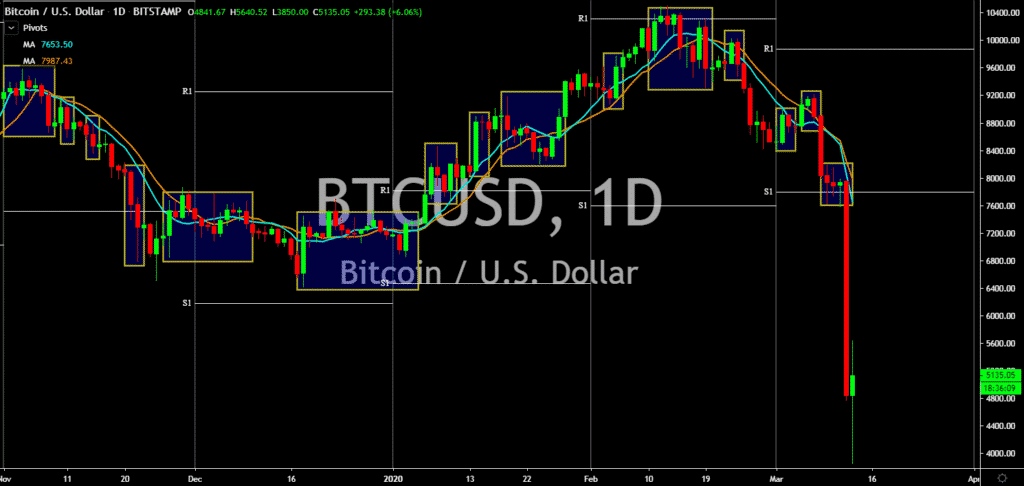

Let’s look at the final possible sign of an upcoming recession. Though it has been overly volatile in the last couple of months, Bitcoin is also being affected by this whole crisis. This stands as proof that gold will always be the true safe haven of the market, and no matter how much BTC tries, it can’t catch up. Looking at the chart, you can see the immense rise at the beginning of 2020 after a steady drop. At the end of February, when the virus hit the peak, it began to fall non-stop. There seems no end to the drop due to the open-closes. But there’s always a silver lining. The price is as low as it will ever get, and it also must rise in the upcoming months.

Conclusion – We’re Facing a Crisis

We are about to face yet another crisis in this century, but after the first crisis, we already know enough to be able to handle this upcoming one. What matters most is that you don’t get out of the market while it’s weak. The weaker it is, the easier it is to dominate. Once you dominate the market, the sooner you will begin making huge amounts of profit. Just remember to watch the stocks and make sure that you don’t fall for FOMO.

The most important thing is that you must invest in the most common but demanded assets now so that after there is a restoration, the demand will rise even higher. And we all know how higher demand raises our profits even higher.

All of the information included in this article is opinion and should not be taken as direct advice.