18 April chart overview for Bitcoin and Ethereum

- The price of Bitcoin broke below the $ 40,000 level early this morning and stopped at $ 39,600.

- Much like Bitcoin and Ethereum fell as the day began.

- There was an outflow of more than a billion dollars in Bitcoin from one of the world’s major crypto exchanges.

- The crypto market lost $ 80 billion in one day as bitcoin dropped below $ 40,000.

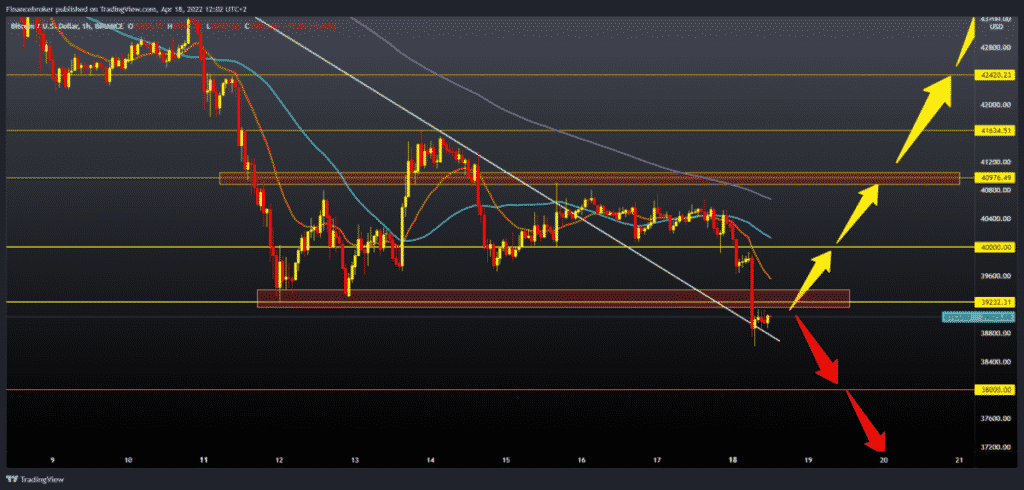

Bitcoin chart analysis

The price of Bitcoin broke below the $ 40,000 level early this morning and stopped at $ 39,600. After that, we saw a shorter recovery and retest at $ 40,000, and then a new stronger pullback priced below the $ 39,000 level. Bitcoin has stopped at $ 38,600 price, and now we have a new recovery and consolidation of about $ 39,000 price. Moving averages are on the bearish side, increasing the pressure on the price. Our next lower support zone is at the $ 38,000 level, and the last time we were there was a month ago. We need a new positive consolidation and a price return to the $ 40,000 level for the bullish option. A price jump above would bring us above the MA20 and MA50 moving averages, positively impacting the price and potential recovery. Our next target is the zone at 41,000 dollars, then last week’s high at 41,635 dollars. If bitcoin manages to make that move, we will get additional support in the MA200 moving average. Further positive consolidation would affect the price and potential recovery above $ 42,000.

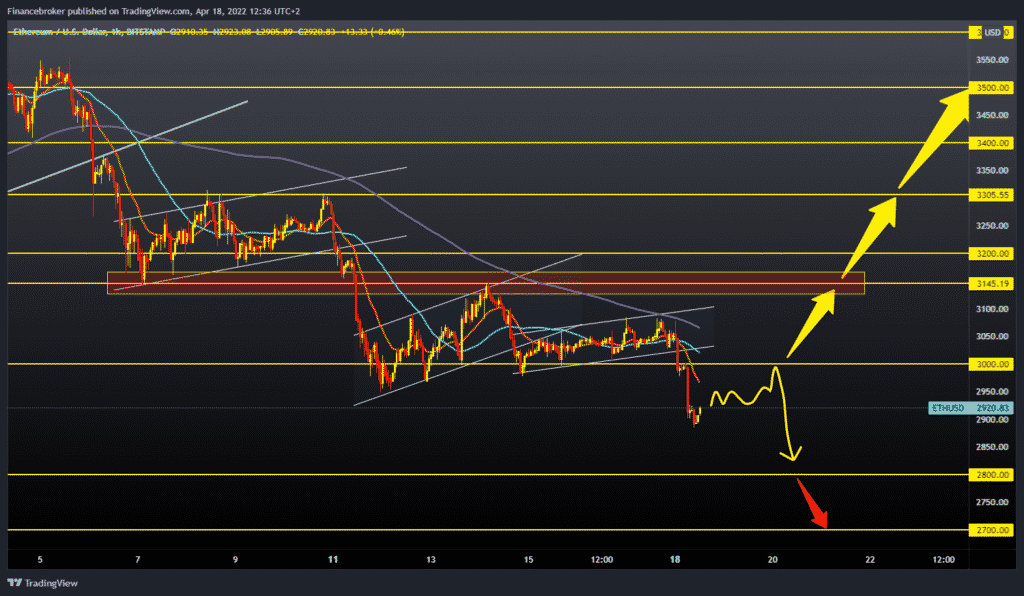

Ethereum chart analysis

Much like Bitcoin and Ethereum fell as the day began. The price made a break below $ 3,000, forming an April low of $ 2,880. We now have a slight recovery in the price to $ 2,915, and there is a chance that the price will retest the $ 3,000 level and continue the bearish trend. Our first lower support is at the $ 2800 level, then the $ 2700 level. For the bullish option, we need a refund above $ 3,000. Already above $ 3,100, we are getting support in moving averages. Such an image would positively affect the image on the chart, which would attract new customers and thus increase the price of Ethereum. Our next target is $ 3145 price previous high from last week. If the price managed to move above $ 3,200, then we could say that there was a significant recovery in the price.

Market overview

$ 1.2 billion (BTC) outflow from Coinbase

There was an outflow of more than a billion dollars in Bitcoin from one of the world’s major crypto exchanges. Faced with a declining cryptocurrency market, the remaining $ 1.2 billion of Coinbase could imply a large increase in institutional investment and acceptance. Despite the reduction in supply, a “capitulation event” could still occur, causing the price of bitcoin to fall as in previous market cycles. Bitcoin (BTC) fell below a critical level of support as cryptocurrency sells deepened. Losses in recent weeks are part of a trend that suggests bitcoin is going lower.

The Bitcoin (BTC) has fallen more than 3% in last 24h, falling below $ 39,000 and its lowest level in a month. Concerns over rising inflation and the Federal Reserve are aggressively tightening monetary policy, putting pressure on the world’s most popular cryptocurrency. As a result, it is expected to fall significantly lower below $ 35,000.

Recent losses in value will encourage a new circle of buyers, raising its price, but BTC’s technical indications have shown that bitcoin has not ended its decline.

Bitcoin market capitalization below $ 750 billion

The crypto market lost $ 80 billion in one day as bitcoin dropped below $ 40,000. Due to the negative mood of the crypto market, the volume of bitcoin trading in the first quarter of this year is two and a half times smaller than in the first quarter of last year. The volume of Bitcoin trading during the first quarter of the year amounted to approximately 2.42 trillion dollars. This 60% reduction in trading volume was recorded between January and March 2021 by about $ 6.02 trillion. Bitcoin’s market capitalization has fallen below $ 750 billion.