15 April chart overview for Bitcoin and Ethreum

- Thursday was bad for the price of bitcoin, as we saw a new pullback from $ 41,600 to $ 39,230.

- The price of Ethereum is trying to recover after it dropped to 2970 dollars yesterday.

- Data from the US Securities and Exchange Commission show that the Vanguard Group surpassed Muska by increasing its stake in the company.

- The government of Kazakhstan is preparing to raise the tax burden for cryptocurrency miners.

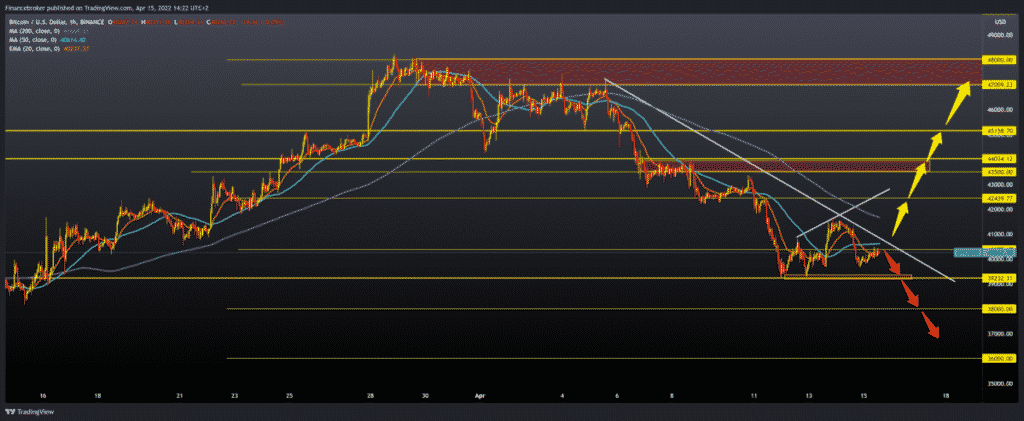

Bitcoin chart analysis

Thursday was bad for the price of bitcoin, as we saw a new pullback from $ 41,600 to $ 39,230. As Friday began, the price of BTC recovered. We are now above the $ 40,000 level again. If the price stays above the $ 41,000 level, it would receive support in moving averages, and bullish optimism for further price recovery would increase. Our first target is the resistance zone from April 13, around 41,500 dollars. A break above could take us to this week’s high at $ 42,440. Our next bullish targets are the $ 43,500-44,000 zone, then the $ 45,000 level and then the March resistance zone of $ 47,000-48,000. We need negative consolidation and a new pullback below the $ 40,000 zone for the bearish option. If this zone does not support us, we are looking for the next one at the $ 38,000 level, the March support zone.

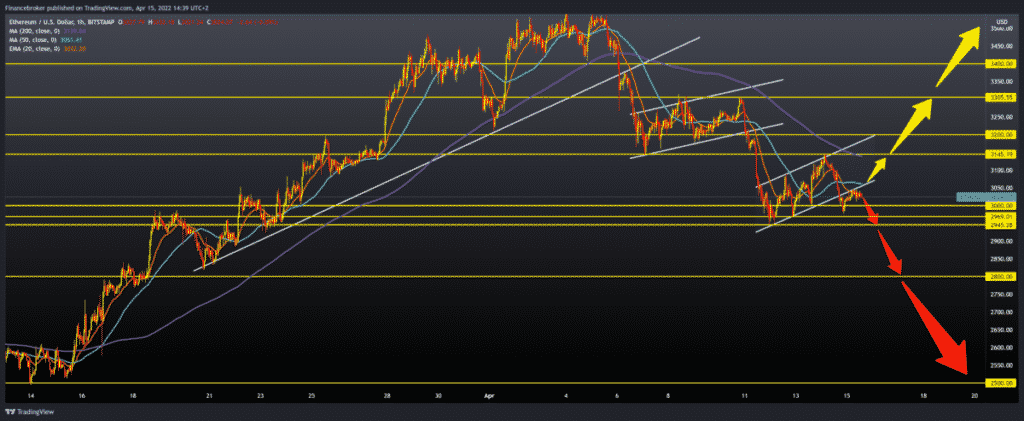

Ethereum chart analysis

The price of Ethereum is trying to recover after it dropped to 2970 dollars yesterday. It is currently at $ 3027, and now we need to get back at least above $ 3,100 to escape the danger zone that could drag us into further bearish territory. Going over $ 3,100, we get extra support in the MA20 and MA50 moving averages. Our next bullish targets are first the $ 3150 level (additional support is the MA200 moving average), then the $ 3300 level, last week’s high. For the bearish option, we need continued negative consolidation and a price drop below the $ 2,950 level, this week’s lower minimum. After that, the next potential support is on the $ 2,800 level, the previous low of March 20.

Market overview

Musk is no longer Twitter’s largest shareholder

Data from the US Securities and Exchange Commission show that the Vanguard Group surpassed Muska by increasing its stake in the company.

As of April 8, the Vanguard Group owns 82.4 million shares, or 10.3% of the company, compared to Musk’s stake of about 9.2%.

The announcement comes after Musk’s failure to reveal his ownership on Twitter attracted a class-action lawsuit from the company’s shareholders. Shareholders said Musk, Tesla’s chief executive, made “substantially false and misleading statements and omissions” by not revealing that he had invested in Twitter until March 24, as required by federal law.

Saudi Arabia’s Alwaleed bin Talal added his views yesterday, tweeting: “I do not believe that the offer proposed by Elon Musk is close to the essential value of Twitter given its growth prospects.” According to the Bloomberg index, the Saudi prince has a 4.4% stake in Twitter.

Kazakhstan – higher taxes for crypto miners

The government of Kazakhstan is preparing to raise the tax burden for cryptocurrency miners. Also, he intends to tie a new tax to the value of minted cryptocurrency. Authorities in Nur-Sultan believe such an approach would positively affect the state budget.

Kazakhstan is taking steps to increase taxes for cryptocurrency miners in the country. According to the Minister of National Economy Alibek Kuantyrov, the goal is to calculate the tax based on the market value of the mined cryptocurrency.

A government official noted that implementing such a scheme would increase budget revenues. Miners operating in Kazakhstan are currently paying and paying extra for the electricity consumed.

Mining companies were obliged to pay more than other consumers last summer. Tariffs have been increased at the cost of about $ 0.0022 per kilowatt-hour of electricity used by the energy-intensive industry.