11 April chart overview for EURUSD, GBPUSD and USDRUB

- On Friday, the euro fell to its April low of 1.08500, after which we have consolidation and recovery to 1.09000.

- Pair GBUUSD on Friday fell below its psychological support at 1.30000, forming a new lower low at 1.29820.

- Pair USDRUB tested 75,0000 levels again on Friday, while today, we see a return above 80,0000 levels.

- The United Kingdom’s economy grew only minimally in February, gross domestic product grew by 0.1 % on a monthly basis, which is much slower than the increase of 0.8 % in January. The forecast of economists was 0.3 %.

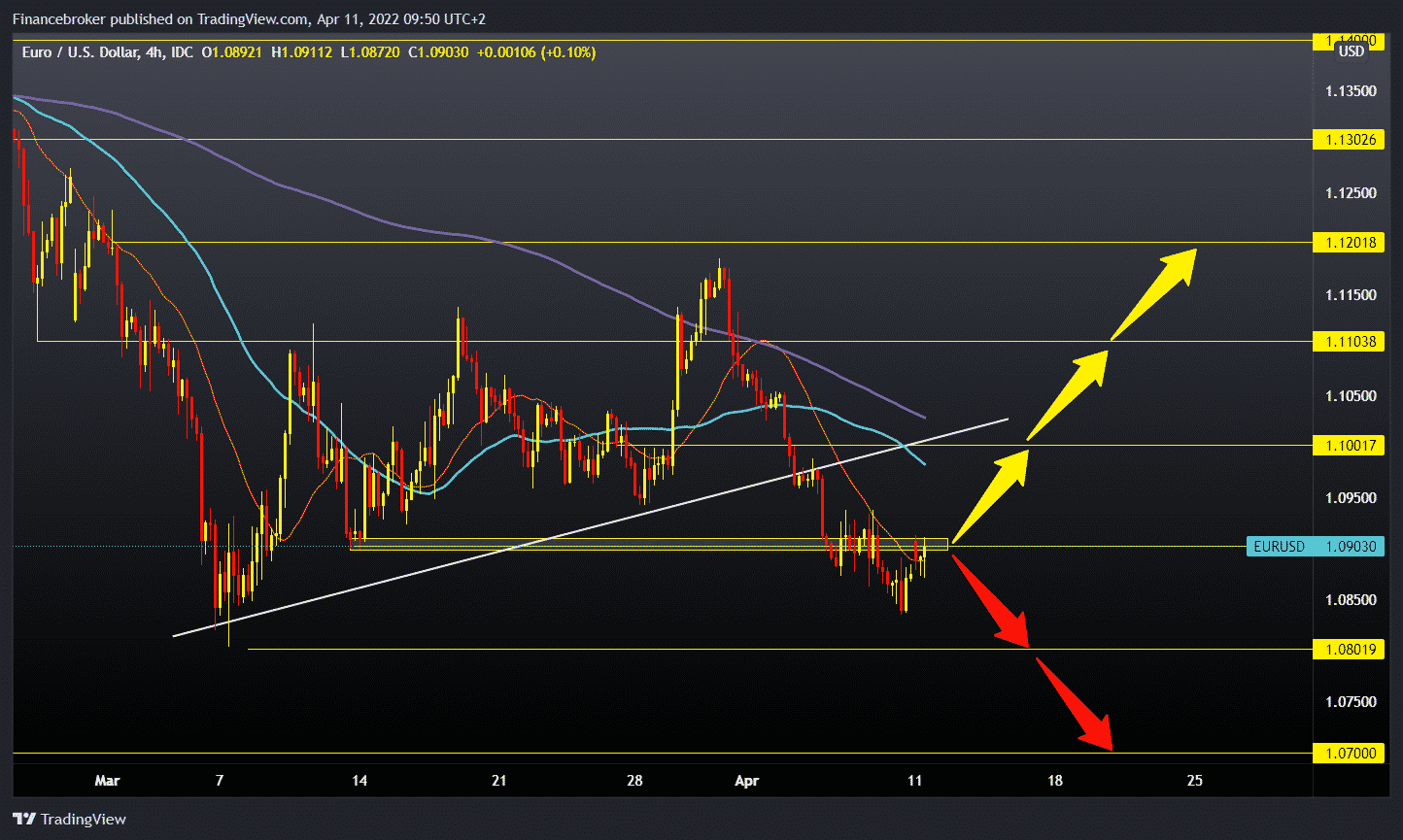

EURUSD chart analysis

On Friday, the euro fell to its April low of 1.08500, after which we have consolidation and recovery to 1.09000. The pair is again above the MA20 moving average, and we can expect a continued recovery towards 1.09500 based on the current situation. Technical indicators MA50 and MA200 are in the zone of about 1.10000 levels. Suppose the euro manages to stay at that level. In that case, there is a likelihood of further recovery and a break above the MA200 moving average, which would be a positive sign for a potential further recovery. If we could see that on the chart, our next target is the 1.11000 level, followed by the previous high from March 31 at 1.11850. For the bearish option, we need a negative consolidation and withdrawal of EURUSD below the previous low to 1.08500. Our next support is at 1.08000, the lower low in March and this year’s minimum. The situation in Ukraine is still active, as are the sanctions aimed at Russia. All this negatively affects the euro and the economy of the European Union.

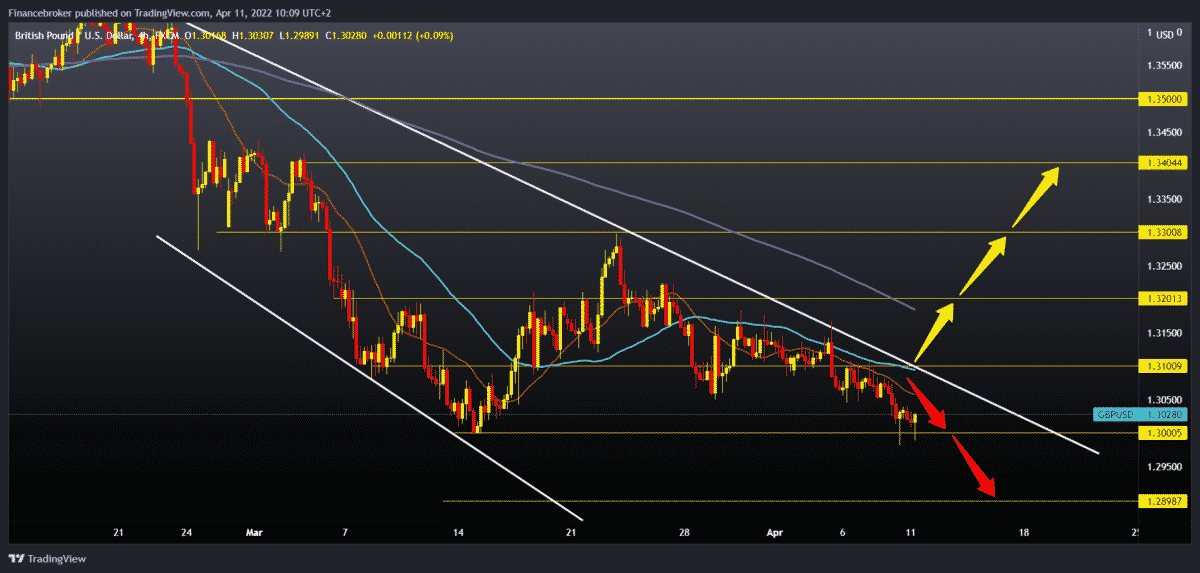

GBPUSD chart analysis

Pair GBUUSD on Friday fell below its psychological support at 1.30000, forming a new lower low at 1.29820. In the Asian session, the pound consolidated slightly and returned above 1,30000 levels. We are now at the current 1.30200. For a more concrete fix, we need to go back above 1.31000. We get additional support in the MA20 and MA50 moving average if we succeed. We will also make a break above the previous line, which would be a good sign for the potential further recovery of the pound against the dollar. Our next target is the 1.32000 level, and additional resistance to this level is the MA200 moving average. We need a negative consolidation and a new GBPUSD withdrawal below the 1.30000 level for the bearish option. Our following potential support zones are 1.29500, then 1.29000. The situation in Ukraine is also affecting the British economy due to the lack and delay in the supply chain, as well as the increase in the prices of all energy sources.

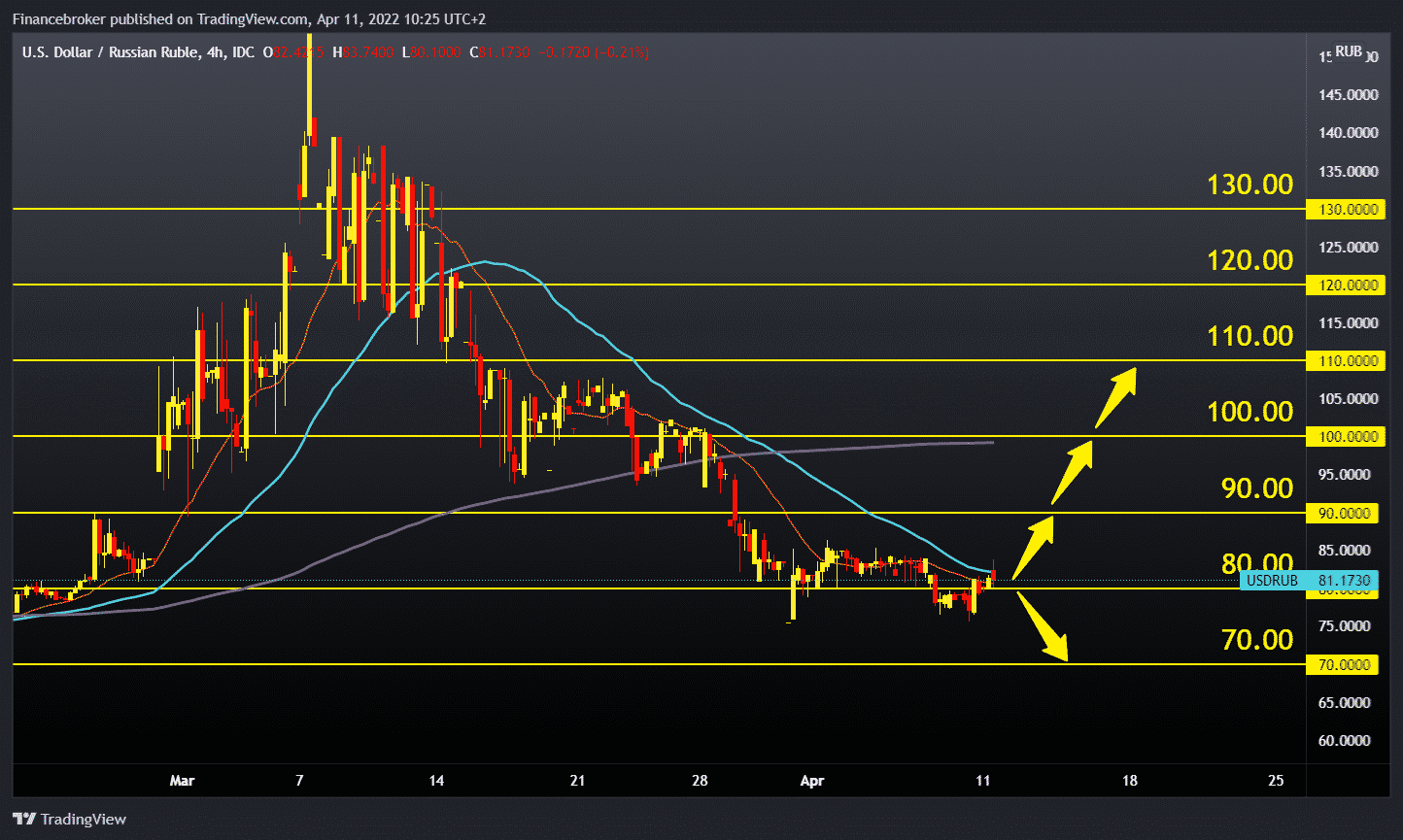

USDRUB chart analysis

Pair USDRUB tested 75,0000 levels again on Friday, while today, we see a return above 80,0000 levels. Moving averages of MA20 and MA50 range around 80,0000 levels. The ruble is now at the level before the invasion of Ukraine. The sanctions imposed by the EU, America and their allies have failed to overthrow the Russian ruble and destabilize the Russian financial system. In general, the sanctions returned like a boomerang to the Western world’s economies, which led to an increase in inflation in all trade segments. We cannot rule out that the ruble will continue to strengthen until the invasion of Ukraine is over. We expect the USDRUB pair in the current zone of around 80,000 to find support and embark on a new bullish boost for our bullish option. Our first important target is the 100,0000 level, where the MA200 moving average awaits us as additional resistance. A break above would boost bullish optimism.

Market overview

The United Kingdom’s economy grew only minimally in February, gross domestic product grew by 0.1 % on a monthly basis, which is much slower than the increase of 0.8 % in January. The forecast of economists was 0.3 %.

Monthly GDP was now just 1.5 % above pre-pandemic coronavirus levels. GDP rose 1.0 % in the three months to February.

On the manufacturing side, services rose 0.2 %, largely thanks to tourism-related industries, with an increase in travel agencies, tour operators and other reservation services.

Industrial production fell 0.6 %, after a 0.7 % increase in January. The manufacturing industry was the main driver of negative growth, falling 0.4 % in February.

The news that the economy did not grow at all in February suggests that the economy had a slightly smaller momentum in the first quarter than previously thought.

-

Support

-

Platform

-

Spread

-

Trading Instrument