08 August 2022 chart overview for Bitcoin and Ethereum

Bitcoin chart analysis

During the weekend, the price of Bitcoin was moved in the range of $23,000-23,300 levels. As Monday began, the price of Bitcoin started to its bullish impulse and climbed above the $24,000 level. For now, today’s maximum is at the $24250 level. The price manages to stay above the $24,000 level. And now, we need a positive consolidation from which a new bullish impulse would emerge. Potential higher targets are $24600 and $25000 levels. We need a negative consolidation and pullback below the $24000 level for a bearish option. A price break below would re-invigorate the bearish impulse. And after that, we would again look at the price of bitcoin at the $23000 level. A price drops below this support zone would open up space towards the $22,000 level.

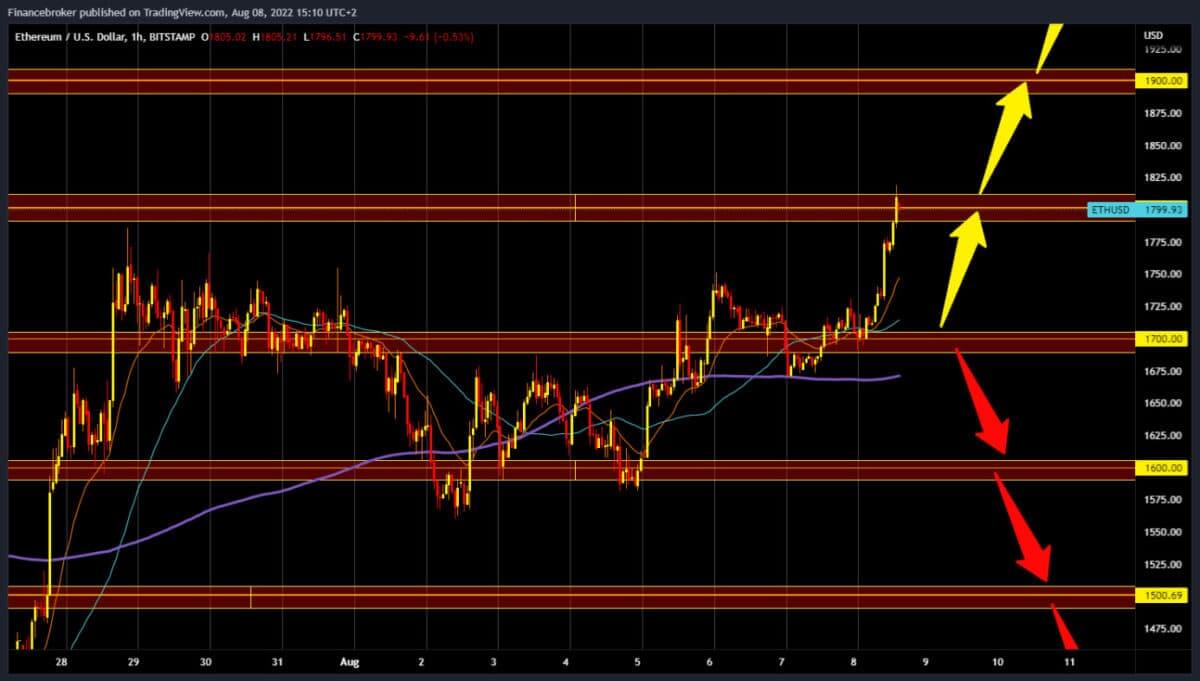

Ethereum chart analysis

The price of Ethereum managed to climb above the $1800 level for the first time in almost two months. This morning, a strong bullish impulse started at the $1700 level. Now we are watching whether the price of Ethereum will manage to maintain at that level and continue towards the $1900 level. It could easily happen that we pause here for a bit before moving on. We need a positive consolidation that will continue to drag the price of ETH towards the $1850, then the $1900 level. For a bearish option, we need a new negative consolidation and a return below $1800. Then the price could further slow down and continue the pullback to the first support at $1750. And if we don’t find that support, we’ll probably see it at the $1700 support zone.

Market overview

Coinbase has faced a torrid period with the entire cryptocurrency world since the tech stock peaked in November. The crypto exchange lost over 88% of its value from November to May this year. Although the stock price managed to stabilize, the news that the US Securities and Exchange Commission was planning to launch an investigation into the company decreased the stock price by over 21%. The SEC’s investigation was based on concerns that the platform offered unregistered securities to its customers. Cryptocurrencies such as Bitcoin and Ethereum that replace “sovereign currencies” are not securities, according to the previous chairman of the SEC. The matter is more complicated how profits and losses are taxed, which is a matter for the Tax Service. Putting all this together shows that the current regulation of crypto assets is too unregulated and vague.